Table of Content

Buying the land to build your house is likely to be one of the most expensive items in the overall construction cost. However, securing a construction loan is already quite complex, and, if you can, it makes sense to buy land separately from your construction loan. There are many factors that you should consider when calculating the size of your construction loan.

But borrowing with bad credit does limit your loan options, which can increase borrowing costs. For example, let’s say you have a FICO score of 510 and can find only one lender willing to approve your FHA loan. If that lender charges a higher-than-average loan origination fee, you won’t have the option of shopping around for lower fees from other lenders. Federal Housing Administration loans are popular among first-time home buyers since they offer lower credit score and down payment requirements. They often have more flexible lending requirements than conventional loans.

Watch our Small Business, Big Heart web series.

Once you finish the basic components of the interior fixtures and drywall, you start on the exterior. That involves installing features such as doors, roofing, walls and windows. This may also be the step where the builders work on walkways, driveways and patios. However, some crews prefer to wait until the very end of construction to pour the driveway. Usually, you can depend on the framing to cost $20,000 – $50,000. So, you will need to factor in how long it will take to complete this stage of construction, along with the amount of materialneeded.

Lots tend to be finished in urban areas, meaning they hook into water lines, sewers and the electric grid. Comparatively, you’re more likely to find unfinished lots in rural areas, resulting in lower costs. The average per-acre cost of raw land in a rural area is only $3,800, according to the United States Department of Agriculture Land Values summary. If you want to start your home on the right foot, you need to choose the land you build on carefully. A plot of land may seem nice but could contain contaminants in the soil, come with high zoning costs or be prone to natural disasters. Location is one of the major drivers of cost when building a house.

Rural Energy for America Program Renewable Energy Systems & Energy Efficiency Improvement Guaranteed Loans & Grants in Nebraska

Allowable packaging fees to any public, tribe or private nonprofit organizations may be included in repair loans and grants. Only if the new loan or construction loan top-up is documented prior to 8 July 2022. Noting that the build loan must have been received and approved by 5pm Friday 8 April 2022.

Migrants, particularly those living in crowded, lower-income neighborhoods, have been experiencing stigmatization related to the spread of Covid-19. For most people looking to buy land and build a house, the best way to arrange a loan is to use it to purchase a build-ready lot with the intention to start construction of a primary dwelling right away. There are things that could go wrong, cause delays, or increase costs along the way, but the timetable is still manageable in the bank’s eyes. The required down payment will typically be in the 15% to 25% range. At a minimum, most lenders require a 20% down payment on a construction loan, and some require as much as 25%. Because construction loans are viewed as higher risk than a traditional mortgage loan, and the lender wants to ensure that you don’t walk away from the project.

Other Requirements

The Addis Ababa Action Agenda and the 2030 Agenda both identify the need for multiple sources of finance to work together effectively and in new combinations. Yet, the international financial architecture is not designed to directly support small ticket size, higher risk transactions that – nevertheless – will be the key to achieving transformative impact at the local level. Access to our online calls for tenders and Plug and Play e-grants platform providing a rapid lifeline for local businesses and local governments, enabling us to support the SMEs and public partners at the local level. The lender must analyze all credit factors to determine that the credit factors and guaranteed loan terms and conditions ensure guaranteed loan repayment. The lender’s evaluation must address any financial or other credit weaknesses of the borrower and project and discuss risk mitigation requirements.

If you have questions, click here to find your loan specialist. We stand up for the small family farmer and rancher, new business owner, and rural communities. For more than 40 years, we've been a leading force engaging people to build a better rural future. Removing inaccurate information can increase your credit score quickly.

Although your lender will determine how much they are willing to lend you, that’s not necessarily how much your monthly budget can afford. As a first-time home buyer, you may not have much to put down on a home. The VA home loan is the easiest 100% home financing option available. Using one or more of these strategies, it’s possible that you could buy a home without putting anything down. In this article, you will learn about a few of these loan types.

Since their inception, flagship welfare schemes of the Modi government such as Namami Gange and Ayushman Bharat have been sanctioned more than what has been spent. A key issue is identifying who to transfer scheme benefits to and how. In 2017 Comptroller and Auditor General of India called Beti Bachao Beti Padhao a failure as per its own objectives. If you plan to self-build, you’ll need to explore the specialized finance available to you. A construction loan, also known as a construction-to-permanent loan, a self-build loan, or a construction mortgage, is one of these.

While building your own home from the ground up can be an extremely rewarding process, landing a construction loan is no walk in the park. To increase your chances for approval, put together a detailed project plan, get a qualified home builder involved, and save up enough money for a large down payment before you apply. Closing costs for construction loans vary depending on the exact terms of your loan, but they normally range from 2% to 5% of the total price of your construction project. This means that if your new home will cost $300,000, then you can expect to pay $6,000 to $15,000 in total closing costs. However, it’s also possible to arrange a separate loan to finance a land purchase.

You’ll also need to supply a comprehensive list of construction details, including everything from floor plans and the type of building materials to insulation and ceiling heights. As agricultural opportunities fluctuate in rural areas, migration, particularly to urban areas, is an adaptation technique to secure incomes and alternative livelihoods. Income generated by migrants is often sent back to family as remittances to support communities at home.

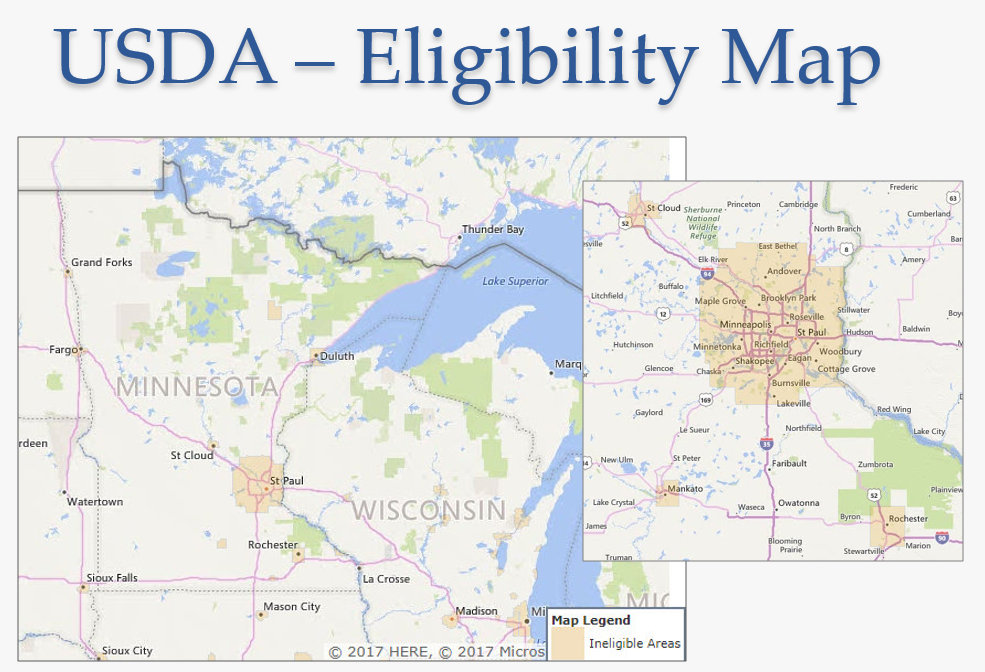

But an applicant with a 640 score and 10% down will be charged a fee of 2.75 percent. Department of Agriculture with the goal of increasing homeownership in rural areas. To submit a mortgage application for this type of loan, the home you’re buying must be located in a qualifying “rural” area — though some suburbs make the cut.

For buyers purchasing an existing home, it’s relatively easy to get approved for a conventional mortgage, as long as they have good credit and reliable income. However, mortgage lenders are far more hesitant to lend the money required to construct a new house. That’s understandable, because you’re basically asking the lender to shell out money for something that doesn’t exist yet. To make matters worse, construction is a risky process, and lenders don’t like risk. Migration, water and climate stress are inextricably linked to rural development.

Estás ingresando al nuevo sitio web de U.S. Bank en español.

These seven mortgage loan programs can help borrowers with lower credit achieve their homeownership goals. If you’re just beginning your research into the mortgage process, you may be feeling some uncertainty about which type of loan will fit your needs. Luckily, there are first-time home buyer loans with zero or low down payment options and programs that could help you bring your dream of homeownership to life. Here are some options for first-time home buyer loans based on their benefits and affordability. Some people want to build their dream home from the ground up. When building your own home, you’re in control of the property and its features.

No comments:

Post a Comment