Table of Content

While building your own home from the ground up can be an extremely rewarding process, landing a construction loan is no walk in the park. To increase your chances for approval, put together a detailed project plan, get a qualified home builder involved, and save up enough money for a large down payment before you apply. Closing costs for construction loans vary depending on the exact terms of your loan, but they normally range from 2% to 5% of the total price of your construction project. This means that if your new home will cost $300,000, then you can expect to pay $6,000 to $15,000 in total closing costs. However, it’s also possible to arrange a separate loan to finance a land purchase.

Disruptions to the supply chains resulted in decreased supplies of raw materials. However, demand remained robust,making it difficult to catch up. Exterior work helps complete the look of your property and generally costs $40,000 – $60,000. Multiple openings and your chosen finish affect this price, though. It supports all the finished features, including your windows, roof, doors, walls, and even garage .

Tax Credits, Rebates & Savings

Because the VA guarantees a portion of your loan, you save on this monthly expense. It protects the lender against any loss if you fail to pay your mortgage. A mortgage insurance premium includes an upfront fee and a monthly cost . You may be able to roll the upfront fee into your mortgage if you don’t have enough cash on hand to pay the upfront fee.

Lots tend to be finished in urban areas, meaning they hook into water lines, sewers and the electric grid. Comparatively, you’re more likely to find unfinished lots in rural areas, resulting in lower costs. The average per-acre cost of raw land in a rural area is only $3,800, according to the United States Department of Agriculture Land Values summary. If you want to start your home on the right foot, you need to choose the land you build on carefully. A plot of land may seem nice but could contain contaminants in the soil, come with high zoning costs or be prone to natural disasters. Location is one of the major drivers of cost when building a house.

Carmelo Anthony, Chris Paul, & Dwyane Wade’s Social Change Fund United Teams Up with LISC

Microsoft previously claimed that Sony is paying for “blocking rights” to keep some games off Xbox Game Pass and now says that’s the case with Call of Duty. “The agreement between Activision Blizzard and Sony includes restrictions on the ability of Activision Blizzard to place Call of Duty titles on Game Pass for a number of years,” says Microsoft in its filings. Xbox Game Pass is also at the heart of the ongoing battles between Microsoft and Sony over Call of Duty. Sony is arguing that Microsoft could take Call of Duty away from PlayStation entirely, while Microsoft says that wouldn’t make business sense. This disagreement has spilled out into a public war of words between Sony’s PlayStation chief and Microsoft’s head of Xbox, but the real conflict is happening behind closed doors. However, a big potential stumbling block for Microsoft’s mobile gaming ambitions could be its control of Call of Duty on both mobile and console.

But you won’t have many choices, and you’ll need to be prepared to make a larger down payment. It will also help if you have few other debts compared to your monthly income. But there are still some “non-QM” loans available with more flexible rules.

Can you buy a home with no money down?

That, in turn, can impact your bottom line while building a new home. Instead, you want your dream home to accurately reflect your style and unique tastes. As a result, any special touches or customizations will result in higher costs.

Dr. Rania Al-Mashat, Minister of International Cooperation of the Arab Republic of Egypt. Several ministers from frontier economies were also present at the investment forum. Addressing the lack of productive, service-oriented infrastructure in urban and rural areas is a key obstacle to local development.

It’s not always available, but when it is, it’s a great help to those buying with a 100% financing mortgage. Fortunately, there are programs for which the government provides insurance to the lender, even though the down payment on the loan is zero. These government-backed loans offer a zero-down payment alternative to conventional mortgages. However, a number of government-backed loans offer buyers the opportunity to buy the home of their dreams without putting any money down. These include the zero-down VA loan and the zero-down USDA mortgage.

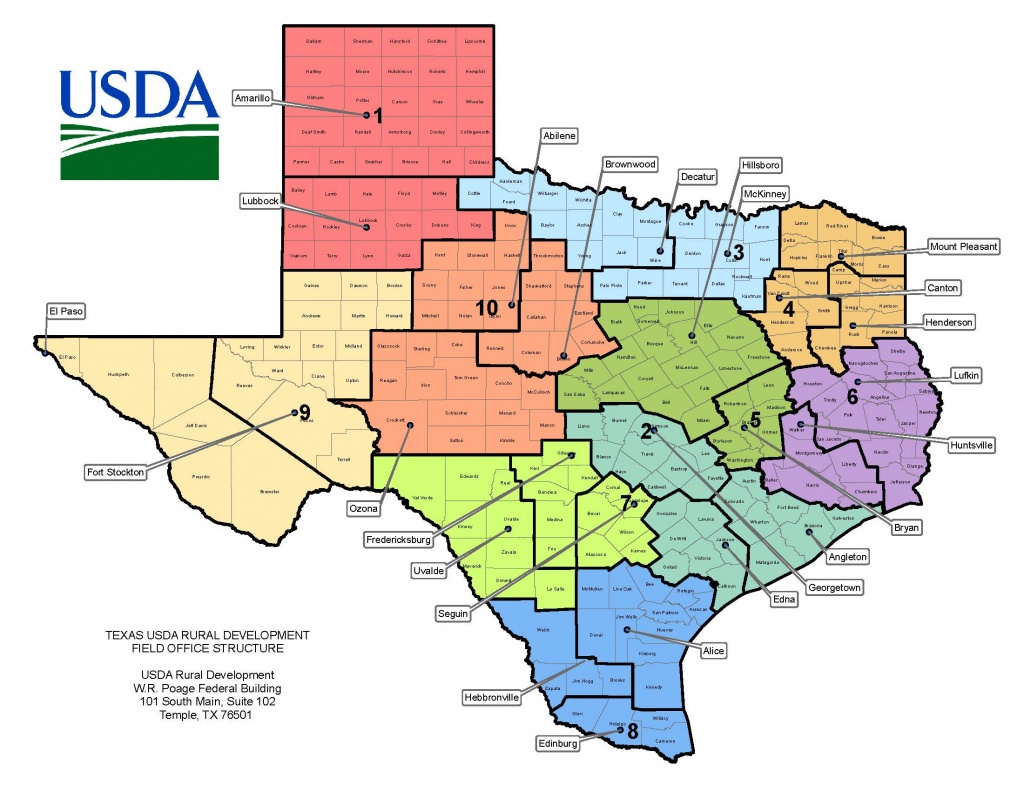

Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, education, and more. Her expertise is in personal finance and investing, and real estate. USDA Rural Development’s Section 502 Direct Loan Program provides a path to homeownership for low- and very-low-income families living in rural areas, and families who truly have no other way to make affordable homeownership a reality.

The 504 Automated Worksheet is a tool designed to identify what type of assistance a homeowner may receive; however, is not a final eligibility determination. Real estate 10 kitchen renovations that will hurt your home’s value A kitchen is often the first room people choose to refurbish in a new property, but they don't always look far enough ahead to when it's time to sell. Real estate Latino homebuyers hit harder with 'affordability crisis' The combination of rising interest rates and high home prices has left them feeling homeownership is out of reach. Real estate A piece of submerged land in Florida is for sale at $43M Buying and selling submerged land is not for the faint of heart with years-long legal battles and environmental pushback derailing many new projects.

If you are already registered with these systems, you do not need to do it again. Applicants must provide at least 25 percent of the project cost if applying for loan. The minimum down payment for a mortgage varies based on the loan type. If you have a military background, you could be eligible for a loan from the Department of Veterans Affairs. It requires nothing down and rates are typically lower than for FHA.

But, your loan amount and the overall cost of your loan may increase. Conventional fixed-rate loans are one of the most common types of home loans. Benefits could include predictable monthly principal and interest payments, lower interest rates and a flexible down payment. Rocket Mortgage® doesn’t offer construction loans, but you can learn more about mortgage preapproval to get a better idea of all your options, including purchasing an existing home. It is critical that the LDC5 Conference delivers concrete solutions that make finance work better for the LDCs and to leave no one behind. In general, you’ll have to pay mortgage insurance when you make a down payment of less than 20%.

Real estate Mortgage rates inch closer to 7%, remain at 20-year high The average rate on the 30-year fixed mortgage edged up to 6.94% from 6.92% last week, according to Freddie Mac. I jumped in with open arms saying, “Yes, I will do it.” Even though I am deathly afraid of heights, but it’s a great opportunity. A Homestar rating recognises design elements that enable homeowners to keep their homes warm, dry, well ventilated and resource efficient. Once you purchase your plot of land, your contractors and subcontractors can start preparing. They’ll need to contact your local municipal office to receive the necessary permits. Sometimes a contractor already has a relationship with your municipality which speeds up the process.

No comments:

Post a Comment